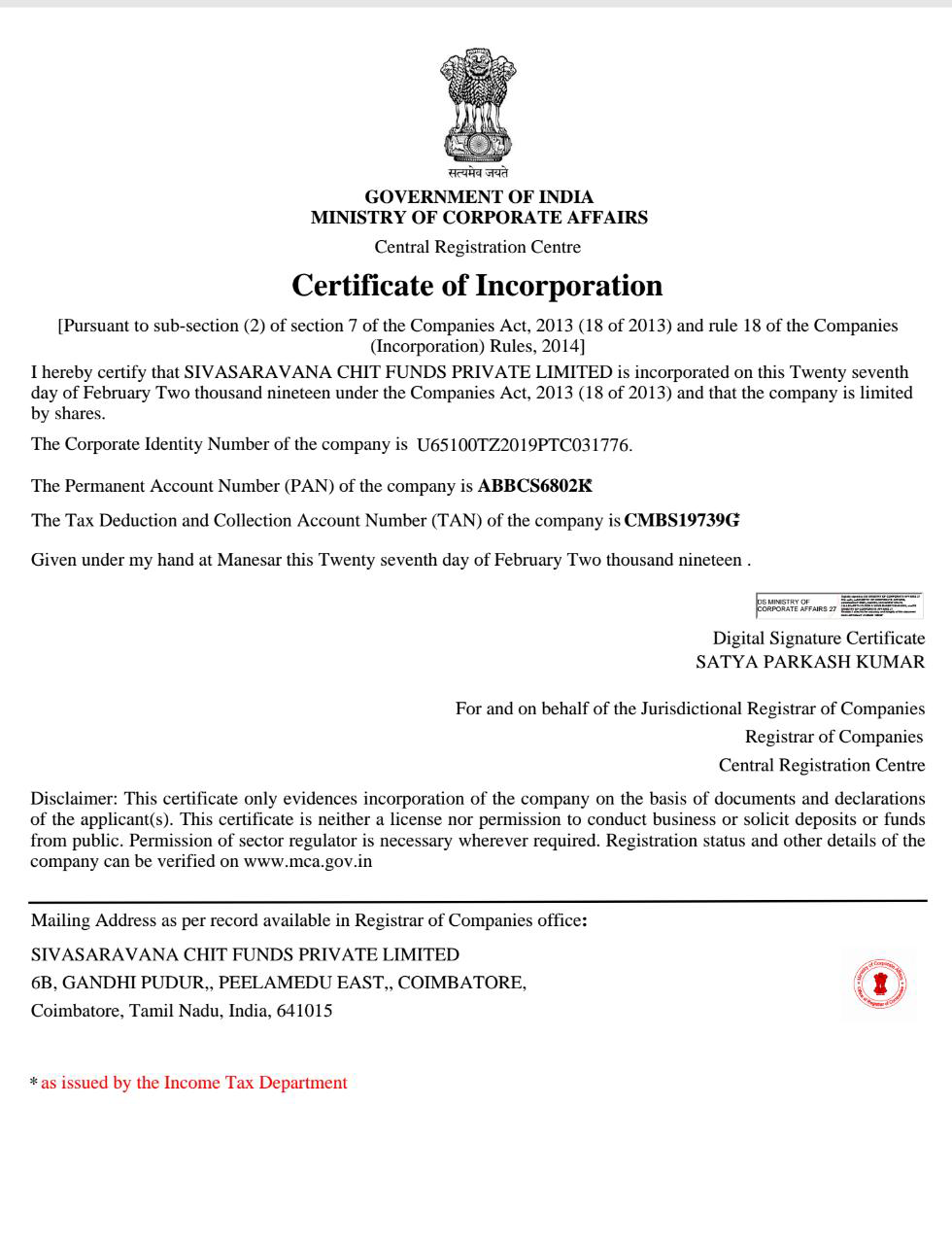

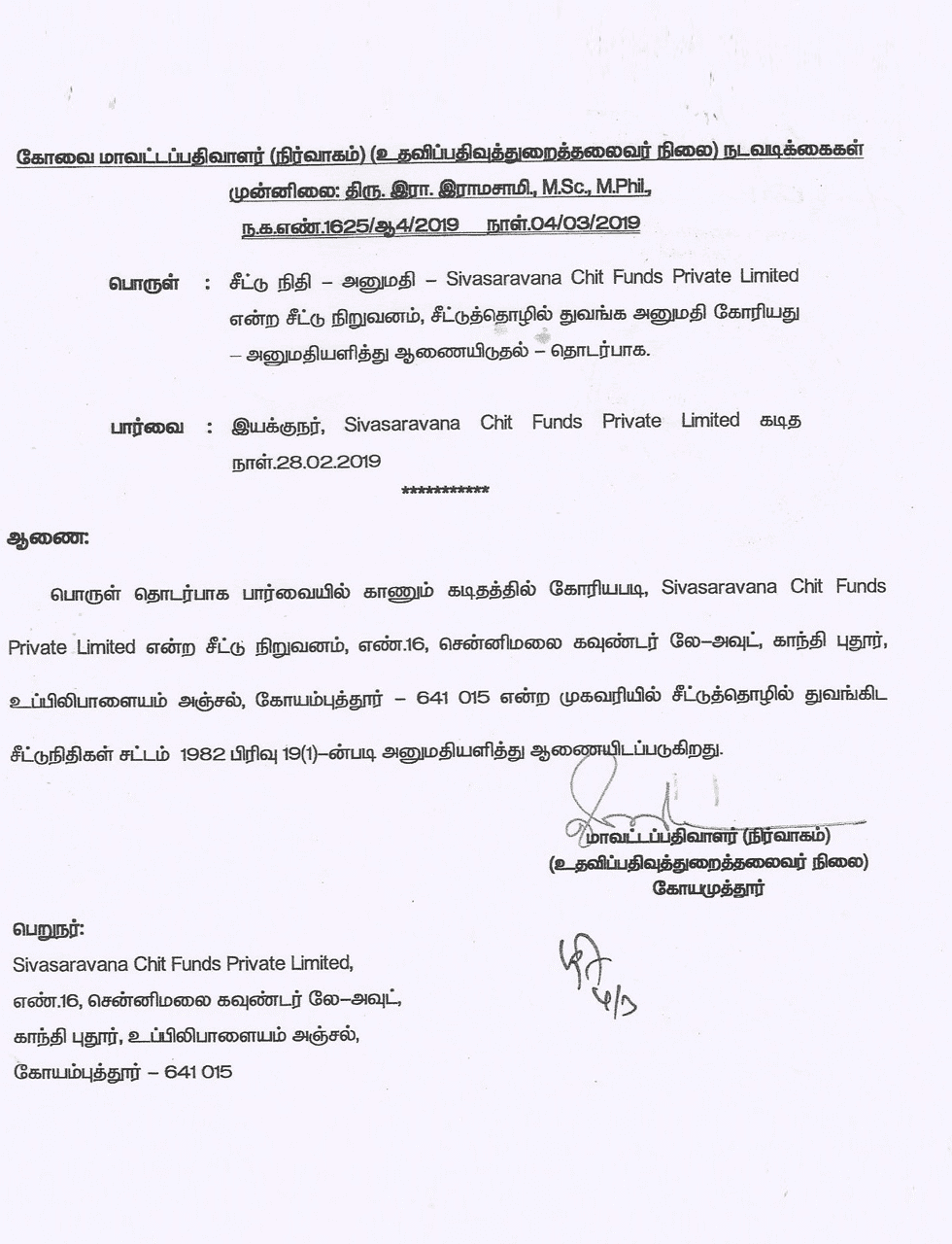

The Privacy Policy governs the use of this website

(https://sivasaravanachits.com/) of Siva Siva

Saravana Chit Funds. By accessing and using our website and services, you agree to be

bound by the terms and conditions of this Privacy Policy of Siva Saravana Chit Funds. By

accepting the Privacy Policy, users expressly consent to Siva Siva Saravana Chit Funds

use and disclosure of their information in accordance with this privacy policy

Siva Saravana Chit Funds is committed to protecting user privacy and working towards

offering users a streamlined and safe online experience. Our web site

(https://sivasaravanachits.com/) does not collect personal information

except when individuals specifically provide

such information. on a voluntary basis. We will not sell or transfer personal

information to unaffiliated third parties unless we have obtained explicit consent from

the User or as otherwise stated at the time of collection.

Siva Saravana Chit Funds treats your personal information as confidential and does not

edit or reveal it to any third parties except where it believes in good faith, such

action is necessary to comply with the applicable legal and regulatory processes. Siva

Saravana Chit Funds and its affiliates will be allowed to share some or all of the

user’s information with another business entity, should the company plan to merge with,

or be acquired by that business entity. In the event such a transaction occurs, that

other business entity or the newly formed entity will be required to follow this policy

down to the letter.

Except where necessary for operational or regulatory reasons, Siva Saravana Chit Funds

will not send you any unsolicited information. If the user does not opt out, Siva

Saravana Chit Funds may use any e-mail addresses of users to send occasional e-mails

pertaining to information on products and services.

Siva Saravana Chit Funds may collect anonymous statistics to measure the interest and

usage of different areas of our website. We will only communicate with users via email

or other if they have opted-in to receive our communications. Users can easily

unsubscribe from our mailing lists by informing us.

Siva Saravana Chit Funds reserves the right to correct any content on our website at our

sole discretion, without prior notice. The content of our website, including information

and materials, cannot be displayed or printed without our prior written approval. Any

reproduction, modification, uploading, downloading, publishing, republishing,

transmitting, or distributing of our website's information or company logo for

commercial purposes is strictly prohibited without our explicit permission. Unauthorized

reproduction of any information or material provided on our website, whether modified or

unmodified, will be considered a violation of our copyright and may be deemed an illegal

act.

Please note that the financial products and information tools provided on our website are

for general information purposes only and should not be solely relied upon for making

financial decisions. We recommend that you contact one of our branches for advice on the

chit fund schemes available

USE OF INFORMATION

The information and materials contained in these pages and the terms, conditions, and

descriptions that appear thereon are subject to change. They should not be regarded as

an offer, solicitation, invitation, advice regarding any financial product of Siva

Saravana Chit Funds. You are therefore requested to verify the information with the

company’s offices before relying on the same. Financial products and services shown on

the website may be withdrawn or amended or varied at any time at the sole discretion of

Siva Saravana Chit Funds.

LIMITATION AND LIABILITY

Please note that Siva Saravana Chit Funds shall not be liable for any loss or damage,

whether direct or indirect, special, economic, incidental, or consequential, arising

from the use of this site or inability to use by any party. We shall not be responsible

for any failure of performance, error, omission, interruption, defect, delay in

operation or transmission, computer virus, or system failure, even if we have been

advised of the possibility of such damages, losses or expenses. By using our website,

you agree to release and hold us harmless from any claims, damages, or other liabilities

arising from or related to your use of our website. Consequently, Siva Saravana Chit

Funds will not be liable for any loss or damage arising directly or indirectly from the

accuracy or otherwise of materials or information contained on the pages of such sites,

or for any loss arising directly or indirectly from such problems.